san antonio tax rate 2021

2021 low income housing tax creditchodo apartment capitalization rates according to house bill 3546. The San Antonio sales tax rate is.

Analysis Texas Property Tax Cut Measure Passed With The Long Game In Mind The Texas Tribune

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2.

. 5182021 41718 PM. For questions regarding your tax statement contact the Bexar County Tax. Medina County Precinct 2 Special Road Tax 00500 Potranco Acres Public Improvement District 05000.

The San Antonio Texas sales tax is 625 the same as the Texas state sales tax. FY 2021 Per Diem Rates apply from October 2020 - September 2021. 48 rows Find the local property tax rates for San Antonio area cities towns school districts and Texas counties.

Only property taxes levied on existing properties not new developments count toward the revenue growth calculation. City of San Antonio 0558270 City. Tax Rate 100.

Jessica Phelps San Antonio Express-News. County officials project a 19 percent increase in revenue because of a tax on new properties and an increase in property valuation throughout Bexar County said Leni Kirkman the University Hospital Systems vice president of strategic. San Antonio has a fixed per-diem rate set by the General Services Administration GSA which is used to reimburse overnight travel expenses within the area for Federal employees as well as employees of private companies which also use the GSAs per diem rates.

What is San Antonio property tax. The current total local sales tax rate in San Antonio TX is 8250. The following table provides 2017 the most common total combined property.

The 825 sales tax rate in san antonio consists of 625 texas state sales tax 125 san antonio tax and 075 special tax. Greg Abbott signed the new law Senate Bill 2 in 2019 and it took effect in 2021 when the citys property tax revenues increased by 31. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City.

The minimum combined 2022 sales tax rate for San Antonio Texas is. 6 rows The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and. 3000 1325 state fee 1150 local fee 5475.

San Antonio collects the maximum legal local sales tax. View all homes on Fawnway. Adopted Tax Rate per 100 valuation General Operations MO 09502.

The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value. The tax rate varies from year to year depending on the countys needs. There is no applicable county tax.

The rates may vary according to the weight. Tax Rates The Official Tax Rate Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for operating budgets and debt repayment in relation to the total taxable value of properties located in the jurisdiction. San Antonio citiestowns property tax rates.

After a contentious debate Bexar County Commissioners on Tuesday approved a 28 billion budget and a reduction in the county tax rate that will shave a. 22 Via Aragon San Antonio TX 78257 is listed for sale for 2250000. The citys revenues for 2022 is 21.

The minimum combined 2021 sales tax rate for san antonio texas is. 39 rows 2021 Official Tax Rates Exemptions. Northwest - 8407 Bandera Rd.

The County sales tax rate is. 867 Fawnway San Antonio TX 78260 is listed for sale for 795000. The FY 2022 Debt Service tax.

The san antonio texas sales tax is 825 consisting of 625 texas state sales tax and 200 san antonio local sales taxesthe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. This is the total of state county and city sales tax rates. The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio.

The December 2020 total local sales tax rate was also 8250. What is the sales tax rate in San Antonio Texas. It is a 048 Acres Lot 6427 SQFT 6 Beds 7 Full Baths in San Antonio.

Southside - 3505 Pleasanton Rd. For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations. Homestead tax exemptions 100 disabled veterans pay no property tax in the state of Texas.

While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected. Property taxes typically are paid in a single annual payment that is due on or before December 31 the final day of the tax year. The 2021 rate of 276237 cents per valuation is mostly unchanged from 2020s rate of 277429 cents per 100 valuation.

The Texas sales tax rate is currently. The property tax rate for the City of San Antonio consists of two components. The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division.

It is a 028 Acre s Lot 3643 SQFT 4 Beds 4 Full Bath s 1 Half Bath s in San Antonio. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. Maintenance Operations MO and Debt Service.

Did South Dakota v. RATES PROPERTY TAX GREATER AUSTIN SAN ANTONIO 2021. Northeast - 3370 Nacogdoches Rd.

This is the total of state county and city sales tax. San Antonio ISD 15023 Somerset ISD 13223 South San Antonio ISDHarlandale ISD 13912.

How To Get Tax Refund In Usa As Tourist For Shopping 2021

Andrew Liang San Antonio Texas United States Professional Profile Linkedin

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

Pin On Real Estate News Tips Advice

2021 2022 Tuition And Fees St Mary S University

Fiesta 2021 Event Schedule Released

Compensation Human Capital Management

Everything You Need To Know For A San Antonio Vacation

How To Get Tax Refund In Usa As Tourist For Shopping 2021

The Conservation Society Of San Antonio Puts Historic Hq On The Market

Adult Community Education Saisd

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Gobankingrates

Road Closures On Broadway In San Antonio Will Continue Through 2024

How To Get Tax Refund In Usa As Tourist For Shopping 2021

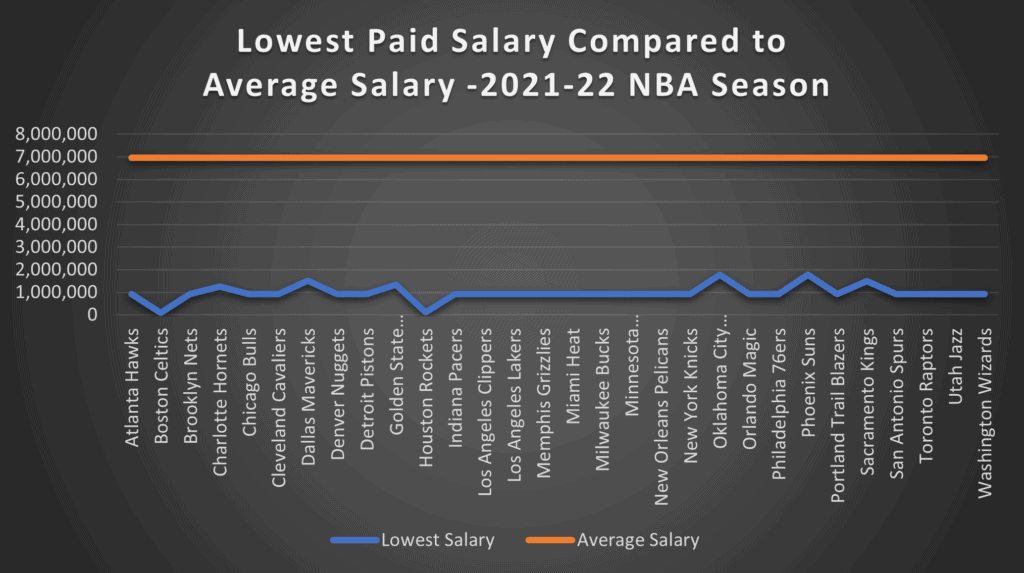

Who Is The Lowest Paid Nba Player 2021 2022 Season Basketball Noise

Everything You Need To Know For A San Antonio Vacation